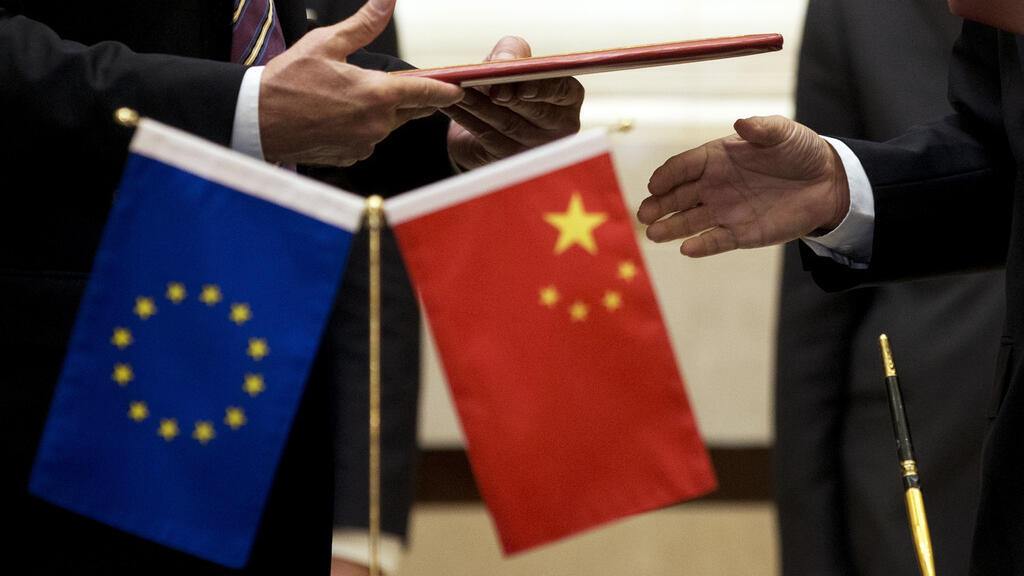

On August 5, 2025, the European Commission issued a preliminary affirmative anti-dumping ruling on high-pressure seamless steel cylinders originating in China. As a result of the ruling, several major Chinese manufacturers will face substantial provisional anti-dumping duties, ranging from 63.2% to 118%, effective August 6. This decision significantly tightens the export environment for Chinese steel cylinder manufacturers in the EU, severely impacting product costs and competitiveness.

On August 5, 2025, the European Commission issued a preliminary affirmative anti-dumping ruling on high-pressure seamless steel cylinders originating in China. As a result of the ruling, several major Chinese manufacturers will face substantial provisional anti-dumping duties, ranging from 63.2% to 118%, effective August 6. This decision significantly tightens the export environment for Chinese steel cylinder manufacturers in the EU, severely impacting product costs and competitiveness.

Scope of Taxable Products

High-pressure seamless steel cylinders,Including compressed or liquefied gas cylinders of various diameters and capacities, whether or not threaded, coated, bladdered, or fitted with accessories.Excluded products: Non-refillable cylinders with a capacity of less than 120 ml (compliant with UN No. 2037 or European Standard EN 16509:2014). Customs Codes: EU CN codes include ex73110011, ex73110013, etc. TARIC codes are detailed in the announcement.

Meanwhile, the EU has launched a new round of anti-dumping investigations against Chinese steel cylinder companies. On August 5, 2025, the European Commission announced a preliminary affirmative anti-dumping ruling on high-pressure seamless steel cylinders originating from China, and imposed provisional anti-dumping duties starting August 6. The specific rulings are as follows:Zhejiang Weneng Fire Fighting Equipment Co., Ltd. is subject to a 63.2% provisional anti-dumping duty;Tianjin Tianhai High-Pressure Vessel Co., Ltd., Jiangsu Tianhai Special Equipment Co., Ltd., and Kuancheng Tianhai Pressure Vessel Co., Ltd. are subject to a 90.3% duty;Non-sampled cooperative enterprises are subject to a 73.8% duty;Other non-covered enterprises are subject to a duty of up to 118.0%.This measure affects multiple tariff codes related to high-pressure steel cylinders, primarily used in firefighting, specialty gases, and industrial gases. Industry insiders analyze that, with some companies facing tax rates exceeding 90%, their export markets are virtually blocked. Companies need to re-position themselves in alternative markets such as Southeast Asia, the Middle East, and Latin America,If a batch of high-pressure steel cylinders worth $100,000 is exported to the EU, at a 90.3% duty rate, the company would have to pay an additional anti-dumping duty of approximately $90,300. Combined with existing tariffs and VAT, export costs would increase significantly, virtually eliminating their price advantage.

Simple formula:Anti-dumping duty amount = export value × applicable tax rateFor example: $100,000 × 90.3% = $90,300

The US steel and aluminum tariffs and the EU's preliminary anti-dumping ruling on steel cylinders both demonstrate that major economies around the world are strengthening industrial protection through tariffs and trade barriers. Chinese foreign trade companies should proactively assess tax risks and optimize customs clearance and supply chain processes to avoid losing orders due to sudden tax increases. Hanyue International will continue to monitor global tariff and anti-dumping developments and provide companies with tax burden estimation, compliance consulting, and cross-border strategy support.