Recently, ports in the United States, Europe, and Southeast Asia have successively upgraded their inspection measures for Chinese export cargo, resulting in customs clearance delays and increased logistics costs.

In the United States, starting August 25, 2025, if selected by customs for EXAM unpacking inspection at the Port of Los Angeles/Long Beach, containers must be picked up and delivered by trucking companies designated by the Customs Inspection Site (CES) or qualified bonded trucks. Regular trucks will be prohibited from participating, significantly increasing the risk of detention fees and logistics uncertainty for businesses. The Port of New York/New Jersey has also increased its inspection rate, with businesses reporting a significant impact on overall delivery times.

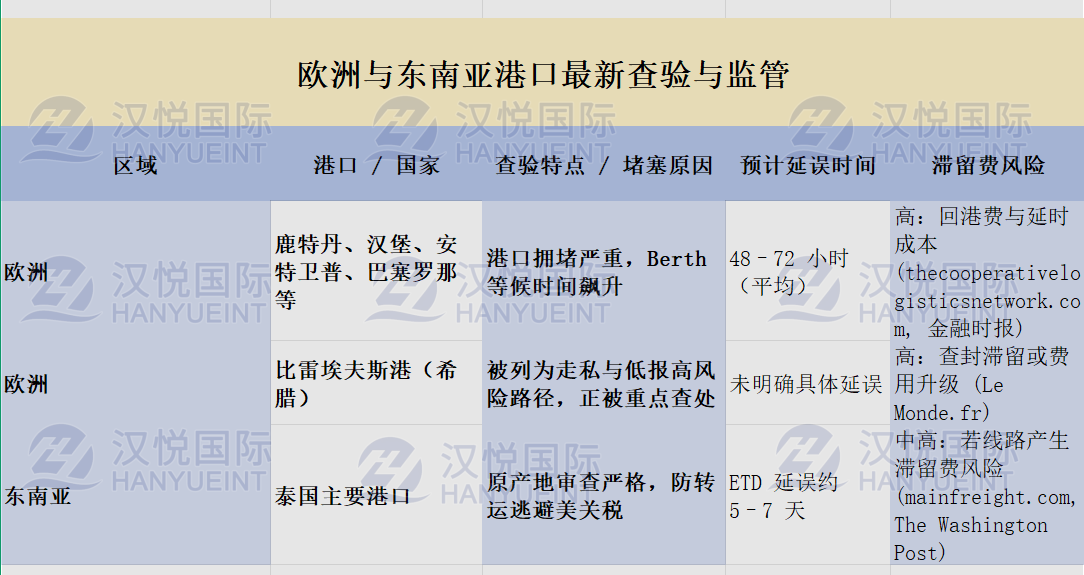

In Europe, major ports such as Rotterdam, Hamburg, Antwerp, Barcelona, and Piraeus have implemented stricter inspection standards for cargo from China, significantly increasing the frequency of inspections and causing some cargo to remain in port for longer periods.

In Southeast Asia, ports such as the Port of Bangkok in Thailand have also recently strengthened import inspections, emphasizing document and compliance reviews.

A simulated case study:

A shipment of machinery parts from a Chinese exporter was selected for unpacking and inspection upon arrival at the Port of Rotterdam. Originally planned to complete customs clearance and transfer to a customer's warehouse in Germany within two days, the actual customs clearance time was extended to seven days due to inspection and supplementary documentation. This resulted in additional storage fees of approximately 800 euros, inspection fees of 450 euros, and penalties to the customer for delayed delivery. Ultimately, the total logistics cost for this shipment was nearly 30% higher than originally planned.

Global customs regulations for Chinese products are tightening, particularly for high-risk and sensitive goods.

Companies should plan shipping times in advance based on their specific export markets and product profiles, and assess the additional costs associated with inspections. Hanyue International continuously monitors multilateral tariff trends, conducts in-depth analysis of customs clearance policies and logistics bottlenecks for materials products, and leverages insights into global trade rules and supply chain structures to provide shippers with cost optimization paths, import and export compliance solutions, and contingency transportation and supply chain backup plans. For the latest tariff list or customized response strategies, please feel free to contact our customer service.